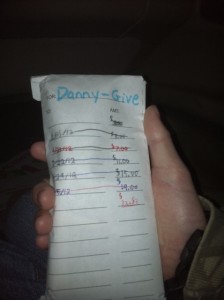

Yesterday while working from home I was given a treat by my daughter K. She had made a batch of brownies for her class for their Christmas party (note how I said Christmas party – you’re allowed to say that at a Christian homeschool school). And she knew I wanted one after she had made the plate for her fellow classmates. However, she called me into the kitchen and proceeded to slice out a very generous piece from the middle. You see, while some in our house fight over the brownie sides – the hard brownie crust that circumnavigates the baking dish, my favorite brownie section lies right in the middle where it is moist and soft. And my daughter knows this. And she wants to please her dad. So she proceeded to cut a triple size brownie section from exactly in the middle to give to me because she knew it would bring me joy. She did this before any of the other brownies had been cut for her or her classmates. She did this not out of obligation, but out of a generous heart. And she did this to please her dad who loves her so much.

Before she scooped out that prime brownie piece for me, I spotted a learning opportunity. I asked her to visualize replacing the brownies with her time, money, and talents. And then to visualize replacing me with God.

Because she voluntarily selected that prime brownie as the first one to serve to me, she did what we are all called to do with our time, money, and talents. We are called to give a tithe, literally translated to 10%, to God in the form of offerings to our church. And this tithe is to be off the top. The Israelites called it “first fruits”. We pay God before we do anything else. And we do it out of gratitude because God is what has given us everything – from our lives to our families to our jobs to our material possessions to everlasting life through accepting his son Jesus. And we do this because we know it pleases God. Just like K knows that I like the middle brownie, we know in Scripture (2 Corinthians 9:6-15) that God loves a cheerful giver.

The lesson sank in and really hit home, both for K and for me. It was a perfectly scripted way to look at God, our tithes, and how we should be returning to Him our time, money, and talents. And in this season of Christmas what better way to honor God’s gift of Jesus by giving back to Him and to others in need.

…..Dan at aslowerpace dot net